Part 2: Should I Purchase or Lease Office Space?

Oct 09, 2013Analyzing Financial Factors

In our first part of the Purchase vs. Lease analysis, we outlined key factors that drive the decision-making process from an operational perspective. The next step is to understand the costs and financial impact of each option. The following are important considerations in analyzing the decision to buy vs. lease your office facility.

Capital Outlay

A significant difference between purchasing and leasing office space is the initial cash required upfront. Typically, when buying office space, financing will be secured and down payments are typically in the range of 15-25% of the purchase price, however a lower down payment may be available through a SBA loan. The cost for improvements or to retrofit the space/building need to be closely considered. When leasing, the initial cash outlay is usually substantially less than purchasing, as typically the tenant improvement costs are borne by the Landlord and amortized over the term of the lease. The lease is secured with a deposit and first month's rent, which tends to be a fraction of the cost of the initial capital outlay when purchasing.

Costs

When projecting future occupancy costs, it is important to understand the different characteristics of each option, so that your business objectives can be supported most effectively. Leasing costs are usually a variable expense with rent increases scheduled over the lease term. Rental rates fluctuate with the market, however when a lease transaction is consummated, occupancy costs are stabilized over the life of the lease, a distinct difference versus buying. When purchasing office space or a facility, you will want to pro-forma your projected costs by including your financing terms (debt service mortgage payments), capital expenditures, improvement costs, and operating expenses. As projections will be based on historical operating expense detail and market information, occupancy costs for ownership are less certain than that of leasing, an important consideration for many companies in terms of cost stability.

Taxes

It is imperative to consult with your accountant to understand in detail the tax implications for each option. Property ownership brings tax benefits through cost recovery by depreciating improvement costs (over 39 years) and deducting mortgage interest. When leasing, rent payments are fully deductible (including the value associated to land costs and if the structure is a net lease, the operating expenses are deductible as well.

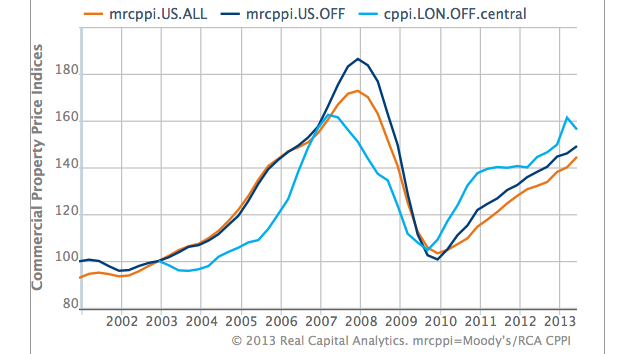

Appreciation

Office property values have been on the rise in the U.S. after the recession and although it's very attractive to consider purchasing your office for the benefit of seeing your asset appreciate in value, it is important to analyze historical data along with future trends. The following chart by Real Capital Analytics shows the Moody’s commercial property price index over the past decade, with office property noted as mrcppi.US.OFF. Like any investment, it is important to “buy it right” and assets with high vacancy present a significant opportunity for corporate occupiers of office space to acquire buildings at values well below the cost to construct a new building.

Contractual Liability (and other strategic considerations)

Leasing, in general, provides greater flexibility as various lease terms allow for a clear exit strategy and ease of disposition as compared to owning business real estate. Securitizing the lease is typically through a cash deposit or letter of credit based upon your company’s financial health reviewed by the prospective Landlord/Owner. In the event the lease needs to be ended early, a termination fee may apply through a pre-negotiated option or through a lease buyout. Another option would be to put the space on the sublease market. Financing is most often obtained when purchasing and be sure to plan accordingly as the loan underwriting process takes time. Make sure you understand the financial impact if the loan is paid off before the maturity date as pre-payment penalties or swap costs may apply.

Balance Sheet Considerations

Changes to the accounting standards have been looming the last several years as the Financial Accounting Standards Board (FASB) has proposed to change the way companies recognize their revenue on their financial statements. The impact on lease accounting will be significant, as operating leases which currently are not capitalized will appear on the company’s balance sheet, in an effort to provide more transparency on financial statements.

Update 11/6/13: FASB has voted to move forward with preparing a final standard on revenue recognition which is expected to be issued in Q12014. It is expected to take effect in 2017 for public companies and 2018 for private companies.

In our next, final post in this series, we’ll take into consideration both the operational and financial factors, highlight cost comparison methods, and lead you in the direction to make an informed decision.